Category: Success Stories

Why Invest in Women in Tech? 7 Reasons Investors and VCs Shouldn’t Miss

It is not only about fighting gender discrimination.

When investors and VCs are confronted with the need to invest in women in tech, some may express their objectivity in their investment decisions, while others may interpret the call as addressing gender discrimination within the tech investment landscape.

The truth is, investing in women in tech is not only a call for inclusion. It is also an opportunity for investors and VCs that can lead to stronger portfolios.

Flat6Labs recognizes this opportunity and is committed to advancing gender inclusion through its investments. With nearly 80% of funding deals in 2023 directed to women-led tech startups, Flat6Labs shares reasons why VCs should back more women in tech.

Reasons Why Investors and VCs Should Invest in Women in Tech

1. Women-led startups generate more ROI

A study by BCG and MassChallenge found that women-led companies yield better returns on investment (ROI), generating 35% higher ROI than men-led companies. This is just one study out of dozens of other studies that reached the same conclusion; women founders outperformed their male peers.

2. Women-led companies are underfunded

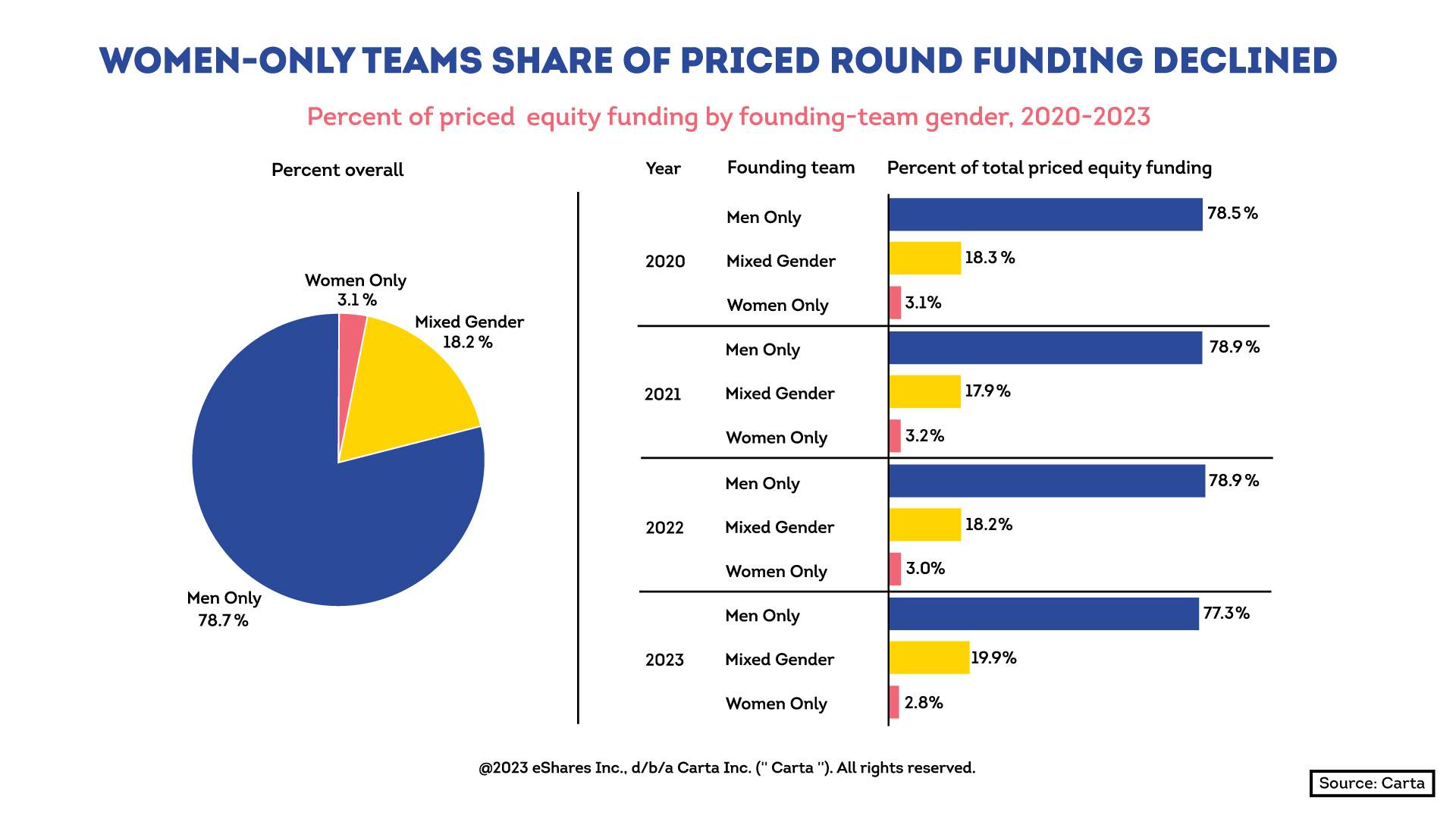

Despite the evidence that women-led startups outperform, women-led startups raised only 2.8% of all venture capital funding, according to Carta’s annual equity report of 2023.

Meanwhile, according to Startup Genome, 15% of tech startup founders are women, while about a third have at least one woman founder worldwide.

The gap is clearly shown as women represent a meaningful share of founders while having their startups underfunded nevertheless, presenting an opportunity for investors to take the lead and reduce the gap.

3. The stereotype against women in tech was based on a faulty study

In 1966, System Development Corporation (SDC), a computer software company based in Santa Monica, California, hired two psychologists, William M. Cannon and Dallas K. Perry, to develop a personality profile for programmers. The goal was to assist SDC’s recruiting process and enable the company to predict the best candidates.

According to Emma Jones, CEO of Project F, Cannon and Perry interviewed a predominantly male sample of engineers to develop this profile. Of the 1,400 engineers they interviewed, 1,200 (86%) were men. As a result, the profile they developed disproportionately identified men as ideal candidates for programming jobs and penalized extroverts and people who have empathy for others, traits that women were more likely to carry compared to men.

This faulty study has had a heavy influence on the industry, impacting how companies have viewed ‘ideal’ programmers and their recruitment practices for decades. Even today, we hear statements such as “women are not good with computers” or “STEM is for geeks”, which are misguided and reinforce biases that limit diversity and inclusion in the field.

4. Women founders are more likely to generate jobs for women

As Maya Oda Pacha, Investment Associate at Flat6Labs, mentioned, “Women founders tend to have more women employees hired at their startups, which contributes to reducing the gender inequality in employment.”

Flat6Labs investment data supports this observation. When we analyzed new jobs created by our portfolio companies between 2011 and 2023, we found that, among women-founded companies, 54% of new jobs went to women. This compares to 32% of new jobs going to women among the remainder of the portfolio.

5. Bias can prevent us from backing investable women-led companies

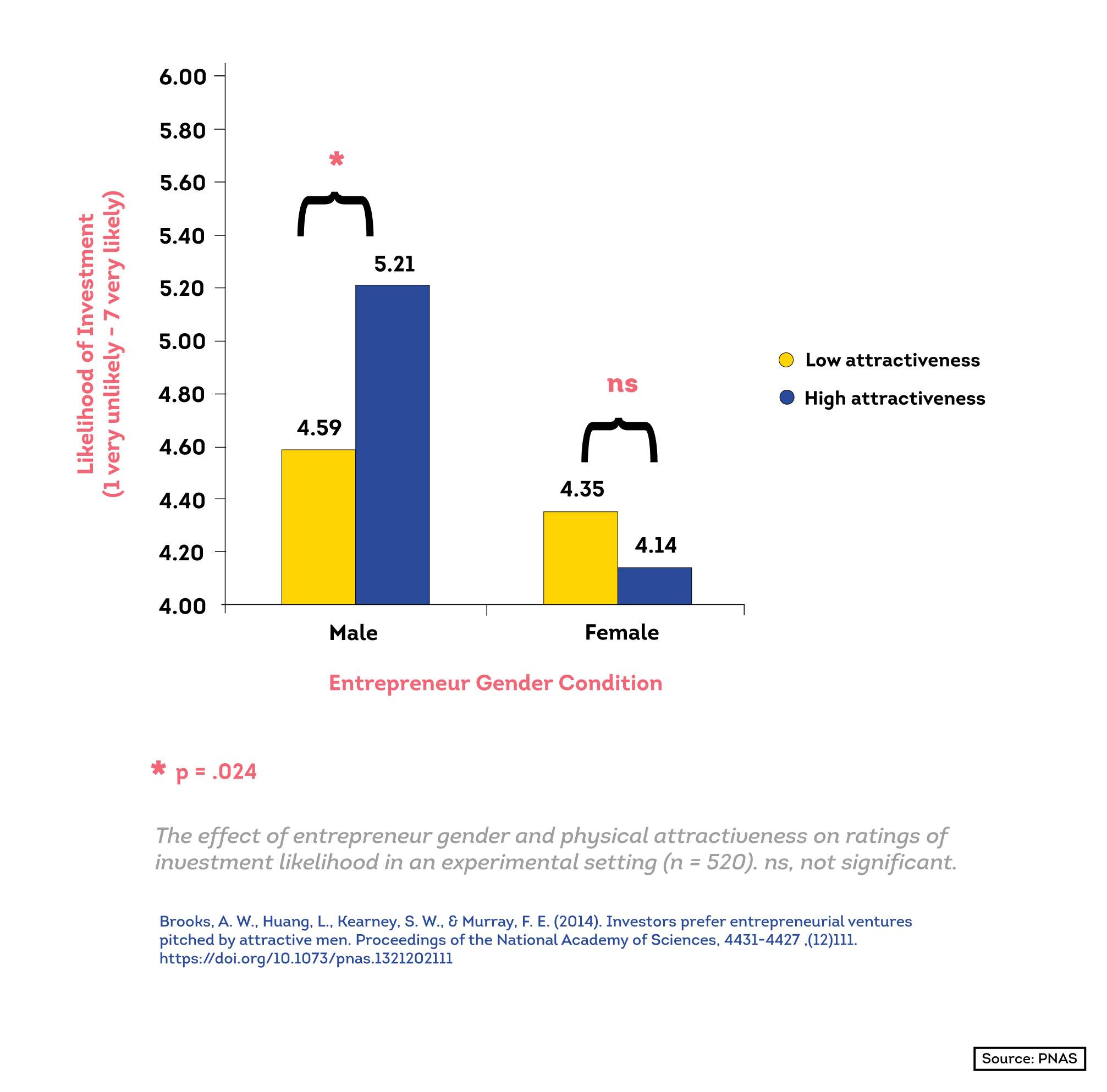

In an experimental study by Alison Brooks and others that tests whether investors made decisions based on gender and attractiveness, investors were shown pitches with typical content and were asked to rate the probability of success for the pitches. Findings show that investors were more likely to to invest in attractive men (average score 5.21), followed by unattractive men (4.59), then unattractive women (4.35), and lastly attractive women (4.14).

To the extent that women entrepreneurs are disadvantaged in entrepreneurial pitching simply by virtue of their gender, then women may remain underrepresented in the entrepreneurial economy, despite their entrepreneurial abilities, because of internal bias.

As mentioned by Kristen Lee in Psychology Today, there is no such thing as an unbiased person. Although all humans have some sort of bias, investors and VCs ought to fight bias and prejudice as much as possible in order to reach wise decisions, because, despite the investors’ preferences for males in the experiment, women founders were factually the ones most likely to succeed in the previously-mentioned study by Alison Brooks and others.

6. Women entrepreneurs are likely to understand their customers

Even in tech industries that target women solely, women founders still receive less funding. In the Femtech industry that focuses on finding solutions for women’s health, male-founded startups raise much more capital than their female peers, with an average of $9.2m, compared to only $4.6m by women-founded Femtechs between 2018 and 2022.

So, with 70% of the Femtech startups founded by women and this significant lack of investment for them, there is more demand for investment than there is supply. This resembles the vast opportunity for investors to tap into an underserved market, yielding substantial returns and driving positive societal impact.

7. Those who are not enabled will never have the chance

A report shared in 2023 provided some shocking statistics, key findings included:

- 56% of women in tech are leaving their employers mid-career.

- Women leave the tech industry at a 45% higher rate than men.

- Only 24% of computing jobs are held by women.

With these numbers, one might consider that women are naturally not interested in/not suited for the tech industry. However, the same research showed that:

- In the tech industry, men are offered higher salaries than women for the same position 60% of the time.

- In 2016, women-led tech companies received $1.46 billion in investments from venture capitalists, while male-led companies received $58.2 billion.

- Computer code written by women was accepted 78.6% of the time on GitHub – 4% more than code written by men – when the coder’s gender was kept secret. However, when contributors are identifiable as male or female, men’s code is accepted at a higher rate.

Therefore, the reason why women are underrepresented in the tech industry is not due to their lack of experience but rather due to having fewer opportunities and not being equally enabled.

Opportunities For Women in Tech in The MENA Region

When asked about the opportunities for women in tech, Doaa Aref, Founder and CEO of our Egypt portfolio company Chefaa, explained, “Theoretically, opportunities in tech for women should be the same as for men.” She added, however, that women usually seek opportunities where gender-based rejection is less likely, “..This is an assumption they (women) may have due to societal pressure. This should be the core problem to solve.”

Consequently, moving towards minimizing the gender gap for founders in the MENA region, some programs are fully dedicated to supporting women-led startups, such as:

- Women’s Health Accelerator: The Women’s Health Accelerator Program, launched by Flat6Labs and Organon, aims to support mostly women-led startups that focus on enhancing women’s health and wellness across the MENAT region.

- She WINS: Flat6Labs partner, IFC, launched She WINS Arabia, a program that aims to help women-led startups across the Middle East and North Africa (MENA) get the advice, mentorship, and finance they need to grow.

Read more about global opportunities for women in tech on TechGuide.

Final Call to Invest in Women in Tech

Flat6Labs’ decade of experience shows how pivotal it is to invest in gender equality by investing in women founders and employees as well; having 51% of women employees and 50% of women at the leadership level at Fla6Labs has contributed to the company’s overall success.

“From that standpoint,” added Maya, “The world needs more women partners at the fund levels who could support female entrepreneurs and consequently support women employment because people tend to invest in people they identify with.”

Investing in women in tech is not just a matter of diversity and inclusion; it’s a strategic decision with benefits that investors and VCs shouldn’t overlook.

As evidenced by numerous studies and real-world examples, women-led startups outperform their male counterparts in terms of ROI and commitment to gender equality. However, despite these compelling reasons, women founders continue to face systemic biases and unequal opportunities.

We need to enable both men and women to reach their full entrepreneurial potential. Founders are not born, they are created, and general stereotypes and biases against women in tech have hindered the creation of talented leaders.

For more information regarding current opportunities for women in tech in Flat6Labs, visit: https://www.flat6labs.com/programs/

Flat6Labs Launches in Jordan: A $20m Seed Fund and Seed Program

Flat6Labs, MENA’s leading seed investor and the largest manager of startup programs in the region, has announced the launch of a new USD 20 million Seed Fund in Jordan. Created to nurture the growth and development of early-stage companies, the Jordan Seed Fund (JSF) has achieved a first close of USD7.4 million and attracted contributions from prominent investors such as the International Finance Corporation (IFC), the Innovative Startups and SMEs Fund (ISSF), Beyond Capital, Bank Al-Etihad, and GMS Ventures & Investments.

Applications for the program’s first four-month cycle are now open. Participating companies will have the opportunity to benefit from a cash seed investment of up to JOD 50 thousand each, together with potential follow-on funding of up to JOD 120 thousand. In addition to attractive funding opportunities, startups will benefit from the Flat6Labs Amman seed program. The program will run over a five-year period and is set to deliver a host of benefits to between 14 and 18 startups every year, including office space, world-class mentorship and access to Flat6Labs’ regional network.

The program is specifically targeted at startups in innovation-based and knowledge-driven sectors such as Information and Communication Technologies, Software Solutions, Education, Healthcare, Digital Content and Games, Hardware, Electronics, Manufacturing Solutions, Renewable Energy, Agricultural Solutions, Big Data and Analytics, FinTech and Payments, Media, and Entertainment. Each of the selected startups will receive tailored support designed to help them scale and grow their businesses, with the long-term goal of creating regional, and ultimately global, champions.

Participating companies will also benefit from opportunities for regional exposure and mentorship through Flat6Labs’ extensive international network, together with coaching from established business leaders. Each startup will be paired with at least three highly experienced mentors. In addition, Flat6Labs Amman will arrange Demo Days, support fundraising and business build-out, and deliver a full spectrum of support designed to help new businesses flourish.

Ramez El-Serafy, Flat6Labs CEO, commented: “We are delighted to expand our presence into Jordan with the launch of an early-stage fund and seed program, which creates exciting opportunities for local startups. As the region’s leading seed and early-stage venture capital firm, Flat6Labs is well placed to support the aspirations of the Kingdom’s talented entrepreneurs and help them take their businesses to the next level. We aim to support the growth and development of Jordan’s start-up ecosystem, and thus contribute to a thriving national economy.”

Rasha Manna, General Manager of Flat6Labs Jordan, added: “Jordan is home to a pool of talented entrepreneurs who are ready to showcase their ideas to the world. We provide foundational support to startups through funding, mentorship and networking opportunities across the region and beyond. We are excited to now open applications for our first cycle and look forward to starting work with Jordan’s most promising startups in the very near future to help them effectively scale and grow their business.”

Laith Al-Qasem, CEO at ISSF shared: “ISSF has been mandated to improve the Jordanian entrepreneurial ecosystem through acting as a fund of funds and through facilitating the creation of new funds to serve the investment needs of entrepreneurs and start-ups along their journey towards success. Flat6Labs fills an important gap and role by providing studied equity capital starting from seed stage accompanied by competent hands on incubation and mentoring which will facilitate speedier and more focused growth in the investments they make.”

“Jordan is an attractive market for entrepreneurship and early-stage capital given its young and increasingly urban population, high rates of technology adoption, and increasing government support,” said Abdullah Jefri, IFC’s Country Manager for the Levant “Addressing the funding gaps will help build a robust startup ecosystem to tap into this potential and spur innovation and economic growth in Jordan and the region.”

Launched in 2011, Flat6Labs has grown to become the MENA region’s leading startup accelerator managing seed funds with a total AUM of more than $85 million. The company has run over 40 seed program cycles, funding the creation and seeding of more than 320 companies. Approximately 40% of Flat6Labs’ graduating companies have succeeded in securing follow-on rounds of funding from regional and global institutions and individuals at higher valuations, translating to an unrealized IRR in excess of 25%.

Applications for the Flat6Labs Amman Seed Program are open now. To find out more, please click below.

Flat6Labs Closes EGP 207 Million of its FAC Egypt Fund, and Increases Cash Offering for Startups

From Left to right: Dina El Shenoufy (CIO, Flat6Labs), Ramez El-Serafy (CEO, Flat6Labs), Marie Therese Fam (Managing Partner, FlatLabs Egypt), Albert Malaty (Managing Director, Flat6Labs Egypt)

Flat6Labs, a regional Seed Program and Fund, announced today the second close and increase of its Egypt fund from EGP50 million to EGP207 million, to support Egyptian early-stage startups. Flat6Labs has also announced that it’s raising its cash seed offering for its Cairo Seed Program to up to EGP1.5M, and up to EGP3M in post-program follow-on funding for selected startups.

The Flat6Labs Accelerator Company (FAC) Egypt fund was launched in 2017 to invest in 100+ innovative startups across Egypt over the span of five years, with a focus on tech-enabled solutions. Over the past three and half years of the investment period, the Flat6Labs Cairo Seed Program has run 7 cycles, invested in 62 startups, trained over 350 founders, and created over 1,000 jobs – 96% of which are youth between the ages of 19-35. Around half of Flat6Labs’ portfolio companies in Egypt have received follow-on funding with a total of EGP145,000,000.

The FAC fund’s existing Anchor Investors include the International Finance Corporation, the MSME Development Agency, the Egyptian American Enterprise Fund, and Egypt Ventures, who have all increased their commitments in the FAC fund to support more early-stage technology startups in Egypt. Sawari Ventures, the latest significant investor in the FAC fund, has also participated in the second close of the fund.

Wael Amin, Managing Partner at Sawari Ventures, said “Flat6Labs Egypt plays an integral role at the seed stage within the local and regional ecosystems; successfully providing the foundational support startups need through funding and mentorship, which is appealing for us. At Sawari Ventures, our fund strategy has always been to allocate a percentage of our fund to the seed stage which is a completely different proposition in terms of process, culture, and support needed. As investors in Flat6Labs Accelerator Company, we get the opportunity to profitably participate in Egyptian companies at a very early stage, get early indicators on ecosystem trends, and visibility into the ecosystem.”

Argineering’s Team, a startup that FAC invested in, at their office.

Marie-Therese Fam, Managing Partner at Flat6Labs Egypt, said “I am extremely proud of our fund’s second close and the incredible support we have received from all our investors.

“Flat6Labs is participating in the development of the startup ecosystem in Egypt. We are proud to support them in helping our community embrace the digital economy”, added Ahmed Gomaa, CEO of Egypt Ventures.

Highlighting Flat6Labs’ role in nurturing a promising startup ecosystem and closing the financing gap for entrepreneurs in Egypt, James Harmon, Chairman of the EAEF, said “We believe that startup accelerators are instrumental to building a robust entrepreneurial ecosystem, we are proud of Flat6Labs’ efforts and role in building the startup ecosystem in Egypt and will continue to support them as they fill an important financing gap in the market.”

Chefaa’s team, a startup that FAC funded, at their office

Hany Emad, Head of Central Sector for SME Finance at MSMEDA, added, “We consider Flat6Labs as one of our strategic partners and due to the success achieved during implementing the first close, we decided to increase our commitment to reach EGP 35 million.”

“We are very excited to expand our partnership with Flat6Labs and increase our commitment to up to $2.5 million. We invested in Flat6Labs back in 2017 as part of IFC’s Startup Catalyst program and have since supported its growth and expansion in Egypt and more broadly in the region,” said Walid Labadi, IFC’s country manager for Egypt, Libya, and Yemen.

Flat6Labs Egypt will continue to support bright, passionate, and tech-driven entrepreneurs in Egypt, by providing funding, technical assistance, and networking opportunities across the country and beyond. Flat6Labs Egypt thus continues to be a pillar of the digital transformation of the Egyptian economy building successful, job-creating startups contributing to the overall economic growth in Egypt.

Applications are now open for Flat6Labs’ Cairo Seed program, apply here.

DisruptAD and Flat6Labs Launch Ignite In Abu Dhabi, an AED 120m Seed Program

DisruptAD, one of the region’s largest venture platforms, is partnering with Flat6Labs, MENA’s leading seed investor and the largest manager of startup programs in the region, to launch Ignite, a new start-up accelerator in Abu Dhabi that will support early stage companies with AED 120 million in funding and other benefits including office space and mentorship.

The program is part of DisruptAD’s broader mission to support and nurture 1,000 start-ups over the next five years and create a thriving local community of founders, fund managers, incubators and accelerators in Abu Dhabi. Ignite will be the first of many such accelerator partnerships for DisruptAD.

The launch of Ignite in partnership with Flat6Labs underpins DisruptAD’s long-term desire to maximize value creation and deliver long-term economic benefits for the UAE by seeding businesses that are technology pioneers and change leaders.

The program will run over a three-year period, investing in 20 startups every year. Applications for the first cycle will be open until 30th of April 2021, offering participating companies the opportunity to benefit from a seed investment worth up to AED 550,000, together with follow-on funding of up to AED 2 million. Startups will also receive tailored support designed to help them effectively scale and grow their businesses to become regional champions and ultimately global champions.

As part of the Ignite program, startups will benefit from opportunities for regional exposure and world-class mentorship through Flat6Labs’ international connections and top-tier coaching. These companies will also enjoy access to DisruptAD’s network and resources. The program will organize Flat6Labs Demo Days, support fundraising and business build out, and ultimately offer the full spectrum of support needed for start-ups to thrive and flourish in Abu Dhabi.

Ramez El-Serafy, Flat6Labs CEO, commented: “We are delighted to partner with DisruptAD for the launch of this three-year program. Flat6Labs’ presence in Abu Dhabi opens up exciting new possibilities, not only for this program but for the long-term evolution of Abu Dhabi as a global start-up destination. Together, we will harness our accumulated knowledge and experience to better serve the entrepreneurial ecosystem and create unique opportunities for promising startups.”

To find out more about Flat6Labs Ignite, please visit this link.

Flat6Labs Launches New Global Brand Identity

Flat6Labs, MENA’s leading seed and early stage VC, and manager of startup programs in the region, introduces a new streamlined visual brand identity and a new unified website. Given Flat6Labs expansive operations and impact across MENA over the past 10 years, the new brand identity is launched to ensure a consistent and enhanced experience for entrepreneurs, partners and investors alike across the region.

As part of the unified brand language, Flat6Labs will now be identifying its flagship VC-backed programs as “Seed Programs” instead of “Accelerator Programs”, while still offering ticket sizes ranging from $50K to $500k, supporting startups through their early journeys from Pre-Seed all the way to Pre-Series A stages.

Flat6Labs also manages a wide range of startup programs across the region, from bootcamps and incubation programs helping entrepreneurs spark and develop venture concepts, all the way to bespoke corporate accelerator programs in different industry verticals enabling startups to build prototypes, and helping them access their target markets.

Ramez El-Serafy, Flat6Labs CEO commented: “Launching this new and unique brand identity is far from just a visual change. We are streamlining our operations across all our offices in MENA, bolstering our efforts to support more innovative entrepreneurs, and laying the groundwork for exciting developments in our offerings to startups and partners that we will announce very soon.”

With an active presence in six countries, Flat6Labs has invested in more than 300 startups to date with a combined investment value of around $35M, creating more than 8,000 jobs across a wide range of industries. Flat6Labs is currently managing a number of seed funds with total assets under management (AUM) exceeding $45M, with more than 20 leading institutional investors and Limited Partners (LPs).

To download the new Flat6Labs brand kit click here.

Flat6Labs Turns 9: A Journey Through Time With 9 Startups

Over the past 9 years, Flat6Labs has enabled the transformation of the startup ecosystem through the 290+ pioneering startups it has invested in, the 660+ founders it trained and mentored, and the 38 Demo Days that exposed the startups to investors, corporates and the media. Flat6Labs has also achieved its first exit in less than 18 months from date of investment; and it’s currently managing AUM of $45mn. Flat6Labs’ portfolio of companies have collectively raised almost twice their invested capital.

Currently, Flat6Labs stands as one of the most active early stage investors in the MENA region, and this wouldn’t have been possible without the team, the support of our partners and mentors, and the belief that the ecosystem has in Flat6Labs.

“Flat6Labs’ 9-year journey has been one that captured the very essence of our belief in the talents, skills, and passions of MENA’s aspiring entrepreneurs. The continuous support Flat6Labs has been capable of giving to its 290+ startups and the successes during the past nine years, wouldn’t have been possible without the amazing team of 50+ colleagues across six countries, 30+ LP investors in our funds and to the thousands of individuals who have believed in us, and in our mission to transform the region through innovation and entrepreneurship.” — Ramez El Serafy, CEO of Flat6Labs.

In hindsight, many of our startups enabled this success by showing great promise, and they have thus become renowned in their respective fields.Nine of these startups are Instabug, Simplex, Sawerly, Clearmove, Moneyfellows, Hawaya, Mint Basil Market, SINC, and GoMyCode.

Instabug (2012 — Flat6Labs Cairo)

Since Flat6Labs Cairo invested in Instabug in 2012, the bug-reporting platform has grown tremendously to provide its solutions to 25,000 companies across the globe and to have its solutions implemented in countless apps across 400,000,000 devices. Their one line of code has attracted tech giants like OnePlus, Ebay, Lyft, EA Sports, Philips, Soundcloud, and more.

Most recently, Instabug has received a Series A funding worth $5M from Accel ,an American VC firm, and other renowned angel investors. In an interview with Waya Media, Omar Gabr, Instabug’s Co-founder said, “We grew 120% in revenues in the last 12 months, adding dozens of Enterprise customers. We’ve always been running a disciplined business, we’re almost profitable for some time now. This is what made our fundraising fast in the middle of all the current events.”

In the upcoming few months, Instabug is aiming to release a number of new services into the ecosystem, as well as expand their operations and their team.

Simplex (2013 — Flat6Labs Cairo)

Simplex has been one of the first businesses in Egypt to create locally manufactured and assembled CNC machines. Being the pioneer it is at that, the likes of the Egyptian Ministry of Transportation and Schneider Electric have relied on their solutions, instead of depending on importing plasma machines and milling machines.

“We have exported a range of our machines to 12 countries so far, and we’ve opened a 5000m2 new factory in 10th of Ramadan, Egypt. Flat6Labs’ seed investment, connections, and continuous support have been paramount to our current success and future growth.” — Ahmed Shaaban, Simplex Co-founder

Sawerly (2014 — Flat6Labs Jeddah)

Sawerly is a Saudi-based online marketplace that connects photographers with potential clients. The startup’s growth over the past years has seen various photographers using their platform as a main source of stable income.

In an interview with Startup MGZN, the Co-founder, Hussein Attar shared “a few photographers are making about 10K SAR a month through our platform so far. We’ve also established a shop in the UAE in the hopes of positioning Sawerly as the go-to place for all photography solutions, and our latest partnership with Silkroad Images as well will allow photographers to sell their photos through our platform.”

Clearmove (2015 — Flat6Labs Abu Dhabi) (Previously known as Sakkini)

Clearmove (previously known as Sakkini) is a mobility platform that helps employers track, deploy, and manage their employees. Their solution has so far been adopted by 500+ entities, and they operate in 144+ countries. The startup has also spent around 150K hours into R&D and has hired over 70+ talents internationally. In 2016, the startup has raised $4m to expand its operations globally, to do more R&D, and develop more alliances internationally.

Moneyfellows (2016 — Flat6Labs Cairo)

The money circles app, MoneyFellows, has taken the liking of many in Egypt since it has transformed the time and effort consuming money-saving circles, into a technologically-enabled service. In 2020, the company raised $4m in a Series A investment from Venture Capital firms, Partech, and Sawari Ventures.

“We’re currently seeking to expand our efforts locally to other governorates in Egypt, and we also have plans to expand regionally by June 2021. You can also expect a line of new services to be launched by next year.” — Ahmed Wadi, Moneyfellows Co-founder

Hawaya (Harmonica) (2017 — Flat6Labs Cairo)

After Hawaya (Harmonica) joined Flat6Labs Cairo in 2017, they have quickly garnered the attention of individuals who are seeking serious relationships in Egypt. The match-making app has since gone to raise funding from both Flat6Labs and 500 Startups in March 2018 worth $150K to double-down on their algorithms and expand the reach of their mobile application.

In August 2019, the startup received an acquisition deal by the Internet Giant, Match Group, which gave Flat6Labs the opportunity to make its first major exit at a 16x return on investment in just over one year. The application later changed its name to Hawaya. Currently, they are expanding into different countries where match-making for serious relationships is desired.

Hawaya now has grown into 13 different markets and has helped over 3 million single Muslims begin their love journeys!

“We’re thrilled to announce that we were invited to ring the opening bell at the Nasdaq stock exchange, celebrating five years of Match Group as a publicly traded company on the US Stock Market and commemorating our success in fostering meaningful connections around the world!” — Hawaya Team

Mint Basil Market (2018 — Flat6Labs Beirut)

Mint Basil Market, The online marketplace for all-natural diet, beauty and household products has been making valiant efforts to impact the Lebanese community after its graduation from Flat6Labs Beirut. Currently, they have been hammering down on their new line of immunity products as COVID-19 sweeps the world. However, after Lebanon was struck with the explosion that took the lives of many and destroyed much of the city of Beirut, the startup took it as a mission to help the Lebanese people through sponsored donation packages to be sent to Arcenciel (a Lebanese based non-profit organization) and has shared a list of psychologists and organizations offering free psychological support. Currently, the startup has its sights set on UAE as a plan of expansion, and they will be joining Womena’s upcoming cycle.

“Flat6Labs has opened a lot of doors for us and we’ll always be grateful for how the team gave up parts of their office space so we could have a warehouse that wasn’t my bedroom in the early days of launching. They’ve also introduced us to one of our angel investors, and were a great support system during some of our most challenging moments. We’re really grateful.” — Vanessa Zuabi, Mint Basil Market’s CEO & Co-founder.

SINC (2019 — Flat6Labs Bahrain)

SINC acts as an employee management platform that helps employers track the activity of employees by recording staff time sheets, on-shift locations, HR notes, safety feedback and more.

In 2019, the company raised $250K in pre-funding. Now, the startup helps 4,000+ businesses manage and track their employees through their platforms in the UK, USA, as well as other countries. The startup has received seed funding from Flat6Labs Bahrain in Spring 2018.

“Flat6Labs were the first people outside of the founders to believe in SINC’s vision. Their early support enabled us to hire our first employees and go on to raise multiple rounds of funding. The connections we’ve made through Demo Day ended up leading to funding and are still influential advisors in our company today.” — Samuel Dolbel, SINC’s Co-founder.

GoMyCode (2020 — Flat6Labs Tunis)

GoMyCode was first funded by Flat6Labs Tunis in December 2019. Since they were funded they have gone to reach more of Tunisia’s coding society to help develop the capabilities of both youngsters and professionals. Their vision is to help create a high-end computer science education for everyone to fulfill their potential and realize their passion for building and shipping real products.

“We’re planning on launching 4 new Hacker Spaces, in Algeria, in Station F in France, Egypt, and Morocco. We’re also currently working on developing a new website and rebranding as well as working on launching a new tech channel: www.gomytech.co. Most recently, we’ve raised $450K to further our growth and help with our expansion plans in the MENA region.” — Yahya Bouhlel, GoMyCode founder.

While innovation is at the core of Flat6Labs and its startups, it takes more than just innovation to success. Our startups across MENA have been resilient, passionate, and hardworking through many challenges, the latest of which is the pandemic. It is not just about innovation, it is also about execution and the continuous drive to bring something new to the table and to impact the community.

Flat6Labs Cairo Alumnus Argineering Launches RGKit Play to Enable Creatives & Designers Bring Their Stories to Light

On the 22nd of September, Argineering launched a crowdfunding campaign on Kickstarter to back up its newly launched RGKit Play that will allow designers, videographers, and creatives of all kinds to add movement in style with their newly launched kit. Support them on Kickstarter here.

The RGKit Play is a modular wireless kit consisting of motors that gives access to its user to modify movement and light using a phone app. Their app in the past has been known for its friendly, accessible, and easy to use interface; one of the key selling points of Argineering’s solutions. Besides that, Argineering plans to offer the new kit at affordable prices compared to competition.

“We’re so excited to see creatives play with movement like pros,” says David Erian, CEO & Co-Founder, “Launching RGKit Play on Kickstarter is a new chapter for us that we have been working towards, for such a long time. It’s a huge step to make RGKit Play accessible to all creatives.”

The kickstarter campaign that Argineering will be launching is to help the startup scale up the production and reach potential customers from all over the world. Currently, Argineering offers 5 kits with the beginner kit starting at $190.

Since joining the Flat6Labs Cairo accelerator program in August 2017, Agrineering managed to expand their product offerings and grow their client-base to include prominent global department stores such as Selfridges and Ted Baker in London; as well as, London’s Science Museum.

Given the considerable growth and progress in the size of their business, Argineering received follow-on investment from Flat6Labs and managed to raise a USD 400,000 Pre-Series A round led by 500 Startups. Throughout and post the program, Argineering won several competitions including “CBC’s Hona Al Shabab Competition” and “The Rise up Pitch Competition”.

Check out RGKit Play on Kickstarter:

Meet Five Flat6Labs Cairo Startups That Secured EGP150m+ During The Last Two Months

Over the past two months, our startups around the region have been facing an unprecedented challenge that is the COVID-19 pandemic. Operations, liquidity and employment have been affected in many industries, but just as these challenges presented themselves, many of our startups adapted to the situation. Five of these startups were capable of securing follow-on funding of over EGP150m in only two months: Brimore, Chefaa, Instabug, Moneyfellows, and VRapeutic.

Brimore (Flat6labs Cairo Cycle 11)

Brimore joined Flat6Labs Cairo 11th cycle, securing a seed fund from our program in Cairo. The startup, well known for its end-to-end distribution platform, caught the eyes of investors like Algebra Ventures and Endure Capital, who helped it raise $800k in seed funding. Lately, it was announced that Brimore had secured a Pre-Series A fund worth $3.5m. The round was led by Algebra Ventures, with the participation of Flat6Labs, Disruptech, Vision Ventures, and 500 Startups.

Chefaa (Flat6labs Cairo Cycle 10)

Over the past few years, Chefaa has been capable of providing lots of customers with much needed medication using their app-based service. After their graduation from Flat6Labs Cairo, Chefaa was capable of securing a six-figure seed round from 500 startups, Flat6Labs and other investors late 2018. A few weeks ago, they had secured their first 7-figure Pre-Series A round from 500 Startups,Vision Ventures, Womena, and other investors.

“We see Flat6Labs as partners of success and they have made it clear on more than one occasion that they invest in people. Their faith in us as founders has had quite the impact on our performance. That affected our business directly and thus catching investors’ eyes. They were among the first believers in our vision & mission. Although COVID-19 has proven to be a global challenge, it has highlighted the gap in the safe digitization of many health care services and with chronic patients at highest risk it just made sense that Chefaa rises to the challenge. We don’t see raising investment as privilege, we see it as proof of past achievement and responsibility towards more to come.” — Doaa Aref, CEO of Chefaa.

Instabug (Flat6labs Cairo Summer 2012 Cycle)

It has been around eight years since their graduation from Flat6Labs Cairo, but during this time, Instabug has been capable of securing well-known clients like Samsung, Paypal, Lyft, EA Sports, Sound Cloud, Vodafone, and more. The bug reporting software, was capable of raising $1.7m from Accel in 2016. This year, they had secured a whopping $5m in a Series A round; making it the largest funding round a Flat6Labs Startup has raised.

Moneyfellows (1864 Accelerator Cycle)

The money circles app, Moneyfellows, was capable of securing a $4m Series A round from Partech Partners and Sawari Ventures in June 2020. Moneyfellows was part of Flat6Labs Cairo x Barclayas 1864 Fintech cycle. This investment has happened shortly after they had raised over $1m in a Pre-Series A round from 500 Startups, Angel Investors, and the Phoenician Fund.

VRapeutic (Flat6labs Cairo Cycle 12)

A finalist at MIT Arab Startup Competition 2017, the winner of SingularityU MENA 2019 $60k competition, and most recently, the winner of the $100k UNICEF grant; this is VRapeutic, a startup that uses VR to help manage and treat patients with ADHD and the many forms of autism.

“Flat6Labs Cairo is a second family, and a place to grow, personally and professionally. It is an accelerator that supports, builds, and cares for its startups. Joining Flat6Labs Cairo is one of the best milestones that every Egyptian startup would want to achieve” — Ahmed Al-Kabbany, CEO of VRapeutic.

Recently, Flat6Labs Cairo had just graduated its Spring 2020 cycle that saw 8 innovative startups in an array of industries showcase their solutions in a digital space. If you are interested in knowing more about our startups, you can experience our Digital Demo Day here. You can also connect with our startups, by clicking here.

How Flat6Labs Startups Are Mitigating the COVID-19 Outbreak Hurdles

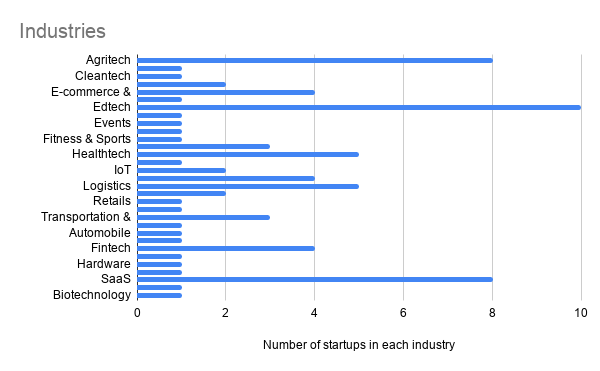

During this pandemic, some industries will grow exponentially, while others will struggle to stay afloat. We set out on surveying a sample of 80 active startups to observe how our founders are maneuvering the pandemic, what is needed for survival and for continued growth and scalability, and how should the founders capitalise on the current situation to maximise their revenues, raise their brand awareness, and develop new products and services.

Our startups are in the edtech, agritech, healthtech, logistics, fintech, IT, transportation & travel, and SaaS industries, and it has been noticed that those whose business models depended heavily on legwork (the physical presence of someone on the job), have either shifted their operations completely online, halted their operations for the time being, or continued operating normally due to the nature of the business model that allows them to do so (for example: the delivery of essential products such as medicine, food, water, & sanitary).

52.6% of the startups surveyed required legwork, and as previously mentioned, were the startups majorly affected by the outbreak, whereas the 46.2% percent that didn’t depend on legwork at all, seem to be either operating normally or their businesses are booming.

With around 61% (49 startups) of the startups sampled not operating normally, approximately 81% (40 startups of the 49 startups) have already devised plans, strategies, and even new business models that allow them to adapt to pandemic, which will be discussed shortly. These startups are in the transportation, travel, agritech, logistics.

The rest of the startups are either operating normally or beyond normal capacity because of the pandemic, and they are in the Edtech, SaaS,

The rest of the startups are either operating normally or beyond normal capacity because of the pandemic, and they are in the Edtech, SaaS, Fintech, E-Commerce, and IT industries.

Industry Breakdown

Agritech

Around 62% of the startups in agritech require legwork, this is because the nature of the job itself demands the installation and maintenance of tech equipment that aid and makes their processes more efficient. Hence their ability to work at normal capacity is affected.

LifeLab Biodesign (Flat6Labs Beirut): They are delaying the legwork farther into the process until the lockdown is lifted. LifeLab designs and deploys fully-automated, climate-controlled vertical indoor farming technologies.

IoTree (Flat6Labs Beirut): They are currently pushing out new features into their already installed products/services to be capable of retaining clients after the outbreak. IoTree is a wireless sensory network of smart traps that are developed using a deep learning algorithm for the early detection of harmful pests and insects in farms.

Conative Labs (Flat6Labs Cairo): They are rescheduling deliveries and dividing the teams so that the workplace isn’t congested. An IoT-enabled water quality monitoring and alarming system for aquaculture.

The plans that they both have devised seem to be common across many of the agritech startups at the moment, and are helping them mitigate the situation.

Healthtech

The results of the healthtech industry were inconclusive, as our startups have very different business models, and most of them require legwork (60%).

Chefaa & Pharmaklik (Flat6Labs Cairo & Beirut): It is important to note that although legwork was required, some businesses weren’t incapcitated by it as they use delivery services to bring medicine to homes. Chefaa, a Flat6Labs Cairo startup, and Pharmaklik, a Flat6Labs Beirut startup, are examples of startups doing well because of the service they provide. Chefaa have also added a new application feature that allows customers to know all about the latest updates of the COVID-19.

MedMisr (Flat6Labs Cairo): They are offering their services at discounted rates. MedMisr is a digital third party administrator providing medical insurance companies an innovative online paper-free solution with fraud controls.

Logistics, Travel, & Transport

Transportation (e.g. ride-hailing), automobile and travel booking platforms have been reported as one of the most “at risk” industries — however, should some startups adapt to the current changes in customer preferences and consider instead the delivery of groceries or medical supplies, they may have a more sustainable business while ensuring they take their customers best interest into consideration (quality and price-wise).

Transpooler (Flat6Labs Cairo): They are considering using their transport tech platform to cater to a different sector (previously students) which would utilize their services more, while managing their expectations it will be still be difficult to acquire customers and convince them to use the platform. Transpooler helps schools and nurseries to monitor their fleet service and offer parents and students live tracking, speed monitoring and chatting.

Wantotrip (Flat6Labs Tunis): They have convinced their travel customers to retain the amount they already paid as credit for future trips (rather than refund) in an attempt to keep their customers on their platform and utilize it once they’re able to travel again. Wantotrip is an international travel platform offering authentic and themed travel packages around the world for communities or individuals.

Shabeb Delivery (a Presentail company) & Hommy Cook (Flat6Labs Beirut & Bahrain): Startups in the logistics industry with a focus on food delivery seem to be doing exceptionally because of the rising need for distancing and having a contactless life during this period. Shabeb is a quick last-mile delivery service for your business, they have also collaborated with the lebanese food back to deliver food to unfortunate families’ doorstep. With the press of a button, we’re at your door in minutes. Hommy Cook helps cooks make money by selling their home cooked food to thousands of customers through Hommycook.

Hovo (Flat6Labs Cairo): They are using the current period as an opportunity to raise brand awareness and have an increased community involvement. They are buying essentials for the elderly and vulnerable families and delivering it to their doorstep. HOVO is a tech-enabled logistics partner that provides trucks in 20 mins across Egypt.

SaaS & IT

Since almost everyone is, at the moment, dependent on online management tools and services that make work life seamless, it was imperative to see that SaaS startups are doing well and even exceeding expectations. In regards to IT, startups were mostly doing well without any legwork, however, some startups that dedicated their services to restaurants for example, weren’t doing that great.

Untap (Flat6Labs Cairo): Untap is collaborating with high profile companies to manage competitions such as organizing an online regional hackathon for Dubai Future Foundation. They have also launched One Million Arab Coders initiative to find solutions to the challenges posed by COVID-19. Untap is a submission management system used by organizations to easily launch and manage online prize-based competitions and calls for applications.

Nural Technologies (Flat6Labs Bahrain): This startup built around the idea of online management of teams and tasks seem to be doing exceptionally well during this period without much required adaptation.

E-Robot (Flat6Labs Tunis): Have shifted most of the engineers work online. E-robot Software develops IT automation solutions to create web and mobile applications without code writing.

Fintech

It is normal to see that the Fintech industry is booming during the pandemic, this is largely due to people seeking safer alternatives to banknotes. In fact, some governments are adapting that kind of technology into the national banks. There was one drawback anyhow, which is financial inclusion. Around 25% of the startups that had its primary focus on financial inclusion through their services are operating below normal capacity. It is important to highlight this shift in the industry trend because during these times, it is even more important to find a way to get to those who are unbanked.

Juno (Flat6Labs Beirut): This startup is targeting the unbanked population and has moved most of its operations online, but they are facing difficulties reaching potential customers. Juno digitizes banking focusing on simplicity and personalization to provide financial services.

-Edtech

It’s no surprise that the outbreak will dramatically transform the global higher education sector creating a new normal for how courses will be taught moving forward; in short, it will revolutionize the online learning landscape which can translate to potentially successful ventures for startups in the Edutech industry.

GoMyCode (Flat6Labs Tunis): GoMyCode has already started adapting by selling online via Facebook and decided to kick off their e-learning platform in the coming few days instead of this September as planned. In an effort to popularize their brand and attain their customers, their platform will be temporarily for free and they managed to also create a community of teachers who will be volunteering. GoMyCode is High-end computer Science Education startup with a unique learning experience that leaves lasting impressions and positively impact our students’ lives.

Spica Tech (Flat6Labs Beirut): Spica Tech has started building an online community surrounding their students where they can share their learnings and progress on the online coding and storytelling program available on the platform — which has been since heavily promoted in order to offset offline learning that some of the students were accustomed to. Spica Tech academy teach kids (5+) and teenagers game development as a way to reshape Science, Technology, Engineering, Arts and Math.

On a regional scale, it has been reported that startups which rely more on legwork are facing increased difficulties managing their business, as well as shifting to the digital landscape since they’re not acquiring enough subscriptions or having sufficient equipment essential for creating content.

E-commerce & Shopping

Cleaning supplies, personal hygiene, supplements among others that the everyday consuIt’s no surprise that the startups that are most likely thriving nowadays are e-commerce platforms where they provide and deliver everyday necessities, from products ranging from healthy snacks,mer will find beneficial in order to combat the new “normal” lifestyle they’re leading today.

Mint Basil Market (Flat6Labs Beirut): This startup is focusing on products that their customers will continue to value in the months to come, and they have been lately adding a new immunity boosting collection of products, ensuring that their platform will be able to fulfill the needs of those who are navigating towards a more healthy lifestyle from the comfort of their home since they also include free delivery (while taking the vital safety precautions). Mint Basil Market is an e-commerce platform that offers a wide range of healthy, natural products, from food to cosmetics, and which can be delivered straight to people’s doors.

SeekMake (Flat6Labs Tunis): In order to help the doctors who are facing the COVID-19 pandemic in Tunis, Seekmake has mass produced masks to help protect frontline doctors who are dealing with the pandemic daily. SeekMake is a marketplace linking CNC, laser machines and 3D printer owners with designers and end users.

Dabchy (Flat6Labs Tunis): A Flat6Labs Tunis startup is increasing their marketing efforts to maintain their involvement in communities by pushing out empathetic messages. They are aiming to reach more people by opting for more ads and less organic content in this period of declining sales and unengaged people. Dabchy is a women marketplace that allows women to revamp their wardrobes easily: they can earn money by selling their used clothing online, buy other clothes at discount prices and share their personal style.

Startups that have a B2B business model or B2C but provide non-essential products and services, such as clothing, jewelry and the like, won’t find success since their customers buying power is on an all- time low for luxury products instead shifting their preferences to food, vitamins, everyday home essentials, sanitary products, among other items that will need to constantly purchase for an unpredicted time frame. An additional problem for these startups is that should they decide to promote their businesses, they can come across as tone-deaf to the financial situations of their audience — it’s increasingly challenging for them to keep their business afloat while retaining the praise of their customers simultaneously. However, the silver lining is that some startups can find success should they be able to pivot by changing their business model to selling products that people can benefit from during their home quarantine (such as home gym equipment, books, toys and games).

Our main takeaways

The industries most negatively affected by this phenomenon were: transportation, travel, agritech, & logistics. On the other side of the coin Edtech, SaaS, Fintech, E-Commerce, & IT seem to be doing relatively well.

For all of the startups, it is highly advised that you begin looking for cash & funding, and cutting down costs without affecting the operations of your businesses. It is also important to start working on research and development, perhaps even pivoting to accommodate the current needs of the market.

When it comes to marketing and sales, if you can’t see your startup being of any help to the people, work on raising brand awareness but be sensitive to other people’s pains. It is due time for some good CSR. Also, a good strategy moving forward with your sales is to offer people discounts, giveaways, and free services in return for their loyalty, and sell (mostly) the things that they need the most at the moment.

It is also a good opportunity for startups to start going online, find a way to make their business become mostly cloud-based. If you can do that, you can truly future-proof your startup.

Check our #StartSmart Webinar recaps:

–“How to Take Off Your Startup During COVID-19” here.

–“How to Out-Innovate” here.

Flat6Labs in 2019: Wrapped Up!

Over the past years, the startup ecosystem in the MENA has witnessed some major changes; and since Flat6Labs’ launch 8 years ago, it has been taking part in this change through its continuous support for innovative startups in more than just one country: Bahrain, Beirut, Cairo, & Tunis. Through these programs, we have invested in 250+ startups over the past years, and 74 of them were in 2019 alone.

One of those 250+ startups is Harmonica, a conservative match-making app that got acquired by the internet giant, Match Group. It is actually the first MENA matchmaking company to be acquired. This acquisition also marked Flat6Labs first major exit, and while we were closing the exit deal in 2019, we’ve also launched the StartEgypt program in two cities: Alexandria and Assiut.

We believe our aspirations are just bigger than one year; however, as 2020 brings in both a new decade and a new year, it is about time that we dug deeper into all that we’ve achieved in 2019.

Flat6Labs growth rates have been exponential thanks to our programs, investors, mentors, and coaches across the region.

Our ability to expand into different countries and cities, has allowed us to reach more of MENA’s hungry entrepreneurial community, one that constantly seeks change, impact, and innovation. This meant that also as we grew, our networks grew and our startups ability to get funded increased significantly.

Our Startups

Flat6Labs has partnered with over 250+ startups across the MENA region in a multitude of industries since its launch in 2011. We truly believe in our startups, their teams, and in what they’re trying to achieve with brilliant products and services. We’re also proud to be their partners, hand-in-hand, throughout their entreprenuerial journey.

Nestled all over the MENA, are our programs that support and invest in startups from the idea, product and market stages alike. The tried and tested Flat6Labs programs cater for a wide array of MENA’s entrepreneurs. In 2019, we launched StartEgypt in two different cities: Alexandria and Assiut. We’ve also powered the Misk Innovation Startup Bootcamps in 5 different cities in Saudi Arabia, supporting a total of 90+ startups.

Our existence in these countries allows our startups to have access to different entreprenuerial and networking events where they can promote their services/products, pitch to investors, or take part in competitions.

The exposure and the network that our startups form at such events help them get funded, in turn allowing them to scale and grow and add new team members as illustrated. This helps the different economies of countries, as it translates into a higher chance at getting employed upon graduation.

Magnitt’s MENA Investment Summary of 2019 has also ranked us as the most active accelerator in the MENA region. With more than 80 startups graduating in one year around the region, and the number of investments we make into our graduating startups, we can’t see that changing anytime soon!

With the support of 20+ institutional investors all over the MENA region, we’re capable of pushing the our limits everyday and supporting more and more startups to grow and scale. We have over $45M in assets under management throughout our funds in the MENA region, from which we provide flexible investment ticket sizes that range between $50k — $300k.

Top 10 Things We’re Proud to Have Achieved in 2019

-

We’ve Made Our First Major Exit From Harmonica, a Flat6Labs Cairo, with a 16x Multiple After an Acquisition Deal from Match Group

-

We’ve Graduated 21 Startups in One Month from Flat6Labs Bahrain (3rd cycle), Flat6Labs Beirut (4th cycle), & Flat6Labs Tunis (4th cycle)

-

We’ve Hosted Our First Regional Demo Day with 18+ Startups Pitching from Flat6Labs Bahrain, Beirut, Cairo & Tunis at Arabnet Riyadh 2019.

-

We’ve Trained 90+ Startup Teams in KSA (Riyadh, Jeddah, Al Madinah, Khobar, & Al Qassim) through the Flat6Labs-Powered Misk Innovation Startup Bootcamps

-

We’re MENA’s Most Active Accelerator According to Magnitt’s MENA Venture Investment Summary of 2019

-

We’ve Launched StartEgypt, a Flat6Labs-powered Incubator, in Alexandria & Assiut

-

We’ve Incubated 45 Startups through the Flat6Labs-Powered Incubator, StartEgypt

-

Our Bahraini Portfolio of Startups Has Collectively Raised $1m

-

We’ve Received Further Investment ($1m) from the IFC into the Anava Fund in Tunis

-

We’ve Launched the Investor Academy in Tunis

10+ Ways Our Startups Were Amazing in 2019

After being accelerated by Flat6Labs and launching its application two weeks before Flat6Labs Cairo 9th Demo Day, Harmonica grew tremendously in 1.5 years to close an acquisition deal with the internet giant, Match Group. Simultaneously, we made our first major exit with a 16x multiple.

Having graduated from the Flat6Labs Cairo Fall 2018, Brimore has established itself as leading channel of distribution for small local manufacturers who want to sell their products. Them receiving funds of $800k signifies that.

After graduating from Flat6Labs Abu Dhabi’s Spring 2015 cycle, the laundry startup, Washmen, was already on a path to becoming one of the leading laundry services in the UAE. Aimed at revolutionising the laundry industry, the startup has been racking up several funds with their latest being a series B round of $6.2m.

Dabchy has grown to be one of Tunis premier online destinations for shopping after their graduation from Flat6Labs Tunis’ cycle one. This has helped them reach over 400k customers in one year, and secure $300k in a seed round led by 500 Startups and joined by Flat6Labs, Saudi Venture Capital Company (SVC), Khobar-based Vision Ventures and Daal, and a group of angel investors.

Chefaa has graduated from Flat6Labs Cairo Cycle 10 with a purpose of making medication easily available everywhere in the country through an application in a timely manner. The’ve been incubated by StartEgypt, then accelerated by Flat6Labs, and they’ve won several competitions propelling them to raising a six figure number led by Flat6Labs and 500 Startups.

The Flat6Labs Bahrian graduated from cycle 2, SINC, has raised US$250,000 in a pre-seed funding round led by Dubai Angel Investors and other prominent regional angel investors. The funds will be used in the short-term to expand SINC’s development team and build out the job tracking functionalities that small businesses in North America desperately need.

Bekia, an online platform that exchanges waste for services, and a graduate from Flat6Labs Cairo Fall 2018 cycle has raised a six figure number ($) through the Oman Technology Fund after partaking in their Wadi OTF Accelerator programme.

One of Flat6Labs Bahrain’s first batch graduates, Dalooni (formerly, Inagrab) was capable of securing an investment from Faith Capital. The startup specialises in monetising the everyday individual as a channel of sales for other businesses.

After successfully graduating from Flat6Labs Bahrain’s first cycle, the Stories Studio was capable of securing a $70k fund from angel investor Mr. Faris Algosaibi.

With an aim to help those with ADHD and Autism progress through VR learning, VRapeutic, a Flat6Labs Cairo cycle 12 graduate, was capable of securing a $70k fund after winning the SingularityU MENA Competition.

-

Rumman Enrolled in Ahli Fintech Acceleration Program

Built around the idea of saving money and allowing users to invest their money in either large or very small quantities, Rumman’s novel solution, had them become part of Flat6Labs Beirut’s program. After their graduation from cycle 2, they were also accepted into the Ahli Fintech Acceleration program. Joining this accelerator will allow them to have access to Al Ahli Bank’s customers, they might receive a fund of up to $300k, and they will get mentorship and counseling from Al Ahli Bank’s top executives, all to ensure that their startup is capable of growing and scaling.

Cloudsale, the Flat6Labs Beirut 2nd Cycle graduate, was capable of qualifying for the final Pitch By The Pyramids competition powered by Riseup Summit. Three other startups from Cairo (Makwa), Beirut (Zima Cloud), and Tunis (Seemba) were among the finalists as well.

Reform Studio joined the Flat6Labs Cairo Spring 2014 cycle with an idea that would help Egypt and the world at large recycle waste to form furniture. They have successfully done so by creating a fiber called plastex. They got them to do a collaboration with Ikea on their Överallt collection to help save the environment,

Speetra has joined Flat6Labs Beirut’s third cycle with a dream to make 3D-printed fashion items that are eco-friendly. This year, they have collaborated with one of the world’s most famous designers to create a sustainable 3d printed gown.